Every few days, Evan Conrad, founder of The San Francisco Compute Company runs the best viral marketing campaign in recent memory. He tweets this:

He doesn’t tell us what the metric was on July 10th, but it doesn’t matter. What exactly does SF Compute do? Also not critical to understand the tweets. All that matters is growth, progress, acceleration. Startups are hard, so who knows, but the vibe is in the comments is: we’re watching the creation of a massive company, and quite likely the beginning of a massive market. The level of certainty, FOMO, and hype downstream of this is hard to overstate.

Why do I bring this up? Well, to the man with a hammer (me) everything looks like a nail (way that we’re not addressing climate change in the right way).

Gigaton or bust

I think people working on climate change, myself included, specifically those in carbon dioxide removal, spent a lot of time crafting a very sharp sword, and then passed the better part of the last five years hurling themselves on it. Trying to put myself back in 2020, I believe the general pattern of thought went:

Climate change is a massive problem

It is important to distinguish between technologies and markets that are of the appropriate scale to have an effect on things like atmospheric CO₂ levels and global temperature, and those that don’t matter because they’re not big enough.

To make those opportunities investable, we must convey to investors that there are correspondingly large market for the kinds of solutions that address these massive challenges.

We need shorthand to be able to reference the two ideas above

“A Gigaton” (a billion tons) emerged as the lingua franca to indicate that some opportunities were both financially large and meaningful to real climate outcomes. A gigaton scale business was good; worthy of attention. This meant that in every pitch, founders of CDR companies had to answer the question of how they were going to be a gigaton-scale business. Decks featured slides in which companies captured a small portion of some future billion-ton market. Investors set requirements for the kinds of opportunities they would invest in (minimum 1Gt per year).

“Gigaton or bust!” they shouted!

“It’s a supply problem!” we called back.

Now all we have to do is climb Everest

I remember how important I thought these ideas were. I was sure we needed to convey the right level of ambition, that we needed to demonstrate we were serious. In retrospect, I undervalued a couple things.

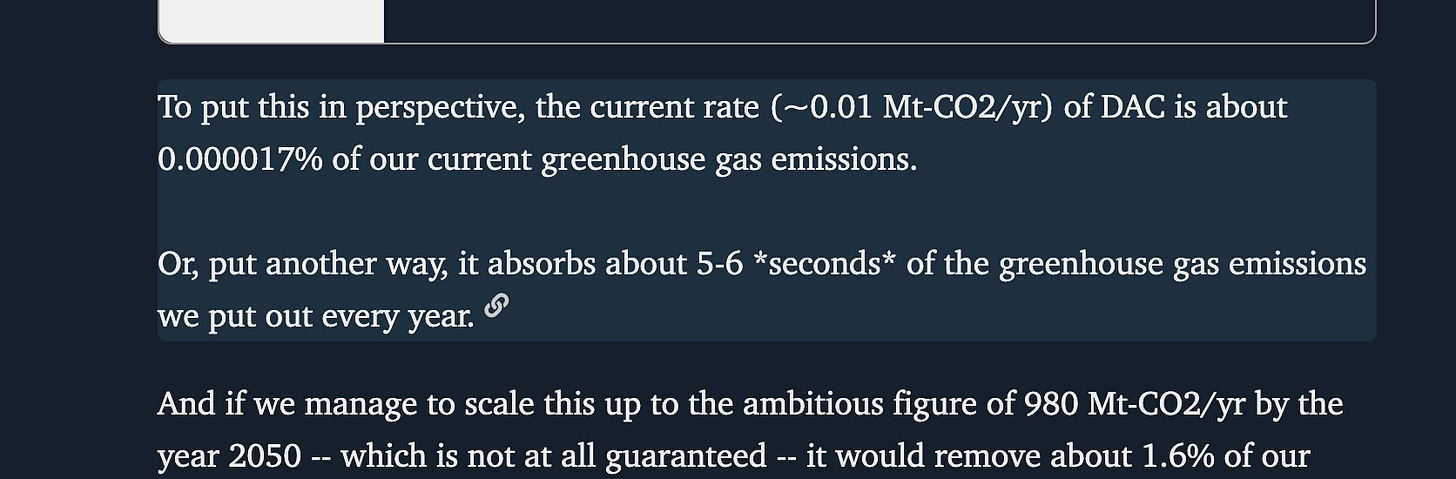

First, incremental progress towards a massive public target is slow, and seems ridiculous. And, particularly vulnerable to ridicule. Do you remember the “number of seconds of emissions” thing? Jon Foley took down his Twitter profile, but the essential criticism of CDR generally (and DAC specifically) was “it’s not big enough to matter.”

In his own words:

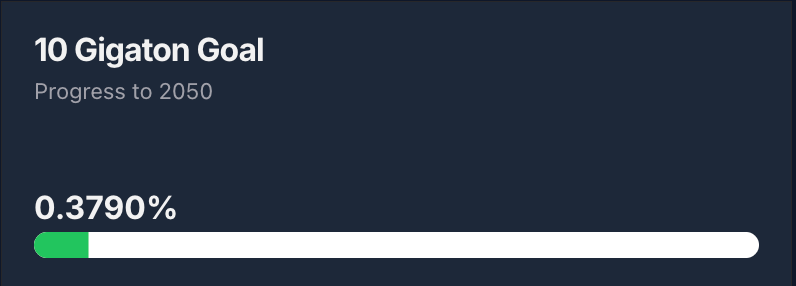

The early deliveries of carbon removal (10,000 tons!) seemed big, and yet, anytime a doubter wanted to put things straight, they could just point at the scoreboard, and, well…

I think now about how demotivating this frame is, and how rarely we do this to ourselves in life. I fear that by framing our work in the context of a gigaton (or ten), we put success over the cognitive horizon, and then were surprised when people had a hard time seeing the future we described.

Second: The graph below is remarkable. A real “J” curve! In any other industry this would be cause for metaphors of rocket ships and calls to get your butt in a seat. Get in now or you’ll miss it! Giddy up, exciting times ahead!

And yet, there is little urgency in the carbon removal market. The “progress towards our goal” target looms large, and gives the industry a crowdfunding energy that doesn’t scream FOMO to buyers or investors. Compounded by the long term nature of decarbonization goals, the need to buy carbon now, to invest in these companies now, erodes.

That the leading buyers and suppliers in the field crafted a J curve out of willpower and compelling storytelling is an astonishing success in and of itself. And yet, I still think we would be better off if we changed our story — from one that focuses on our end goal, to one that focuses on progress.

Niches to riches

I won’t, but I want to copy and paste the entire “Niche Markets” section from Neil Hacker’s post “How solar energy became cheap” (a CDR-tinted review of Greg Nemet’s book by the same name.) You should read it. The key point in my opinion:

Selling solar panels, sequentially, into a small, relatively expensive niche markets allowed solar companies to increase volumes, drive prices down, and access the next niche (which had a marginally lower willingness to pay and marginally higher volumes.) Repeat!

Commercially viable niches existed independent of policy, and acted as a durable (albeit limited) source of revenue and scale for solar companies.

There are many other things to learn from Greg’s book, and Neil’s review, but I want to emphasize this point: Because of our collective story about carbon removal, I believe we prioritized solutions that could scale to gigatons. Emphasizing scale over profitability and utility has left the industry very dependent on policy. In Neil’s words: “Unlike solar, the main future market for DAC, capturing CO₂ to be permanently sequestered basically has no direct utility. That means that governments, who historically have been the parties that are meant to internalize negative externalities, will likely have an expanded role, which just to reiterate they are currently not filling.”

In a world in which generating alignment on climate action is hard, and building supportive government policy is harder, I can’t help but look at Evan’s tweets and think those of us working on climate solutions are under-prioritizing momentum posting.

How many x

Indulge me: Let’s put on our hype-glasses for a moment and surf on over to the twitter profile of a real company, Vaulted Deep. I’m going to Evan-post on their behalf for a moment, using publicly available data. To be very clear: I am inventing this post. But I think it’s helpful to see what it feels like — reading some good news.

🔥🔥🔥🔥🔥

What is this feeling?! Hope? Excitement? The beginning of something very big? And while Vaulted is absolutely on a heater, so are lots of other folks! I could make one of these tweets for so many other companies working on climate solutions. Good news isn’t actually hard to find!

And so I plead: Drop “gigaton-scale” for the moment. File it under Important Things We Can Talk About Later. Be like solar. Crush your niche, lower your costs, make money, then post like Evan. Move to the next niche, repeat.

From niches to riches, let’s go.

Next week:

I’ll be thinking about teamwork: Where is broad alignment on climate action possible? What does narrow alignment look like? What financial tools fit which kinds of alignment?

Getting some structure in place

If you’ve made it here and don’t know yet, well then now is the time. I’m now a Co-founder of Structure Climate with Matt Schmitt. If you’re the founder of a climate company or an investor with a portfolio of climate companies and have been waiting for a sign that now is the time to explore philanthropic private credit, consider this it.

We help founders seeking:

$1-$20 million dollars in debt (on concessionary terms)

We work best with those that have:

An offtake / PO / equivalent demonstration of early commercial viability

A clear sense of their project and financing needs

A corporate entity in the US (best, but not strictly required)

A network of people that know and trust them

Sound like you? Send me an email at peter@structureclimate.com.